Ethica Group MA&A Advisory team, Mergers Alliance partner in Italy, assisted Mindful Capital Partners in completing the acquisition, through its subsidiary Selematic, of 100% of Miele, a leading company active in the production of automated packaging machines in the food, chemical and pharmaceutical sectors. By partnering Miele with Selematic, Mindful is creating a leading company in the primary and secondary food and non-food packaging sector.

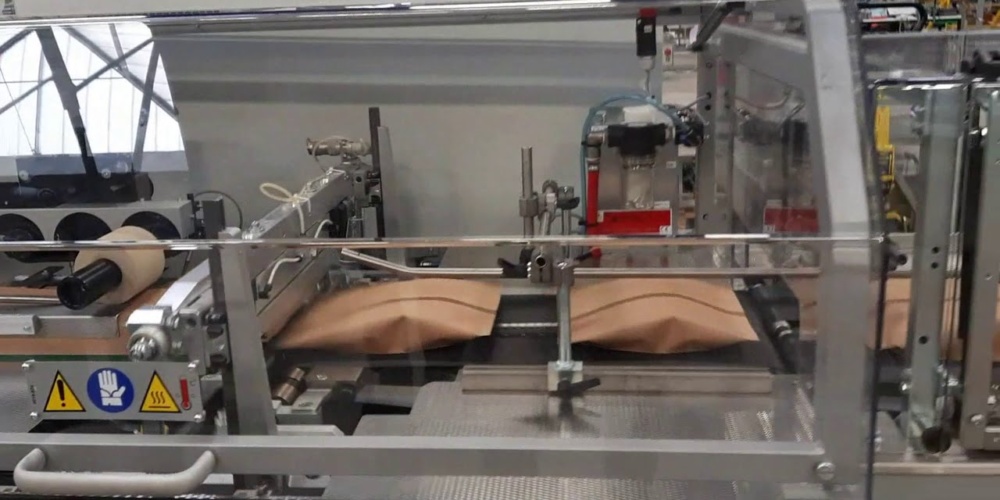

With headquarters in Foiano della Chiana (Arezzo), and over 50 years of activity, Miele plays a leading role in Italy in the production of automated machines for the primary packaging of food, chemical and pharmaceutical products. Vertical, inclined and ultrasonic packaging machines are its flagship products. The high levels of quality, allow Miele to excel in different areas: project, production, flexible internal organisation, sales and after-sales services. These factors integrate and align thanks to the modus operandi of the Miele team: a group of engineers, designers and qualified professionals, committed to searching for innovative technological solutions.

Mindful is helping to create a leading company in the primary and secondary food and non-food packaging sector. Thanks to the integration of know-how and technologies present along the packaging value chain of Selematic and Miele, the newly created hub will be able to provide integrated “one-stop-shop” lines in a wide spectrum of sectors including pasta, cereals , snacks, fresh-cut produce, dried fruit, frozen foods, pet food, etc.

The new group will reach a turnover of almost €30 million with an EBITDA of over €6 million, consolidating its leadership in the domestic market and strengthening its international approach in Europe, MEA, LATAM and North America.