Fausto Rinallo

Ethica Group

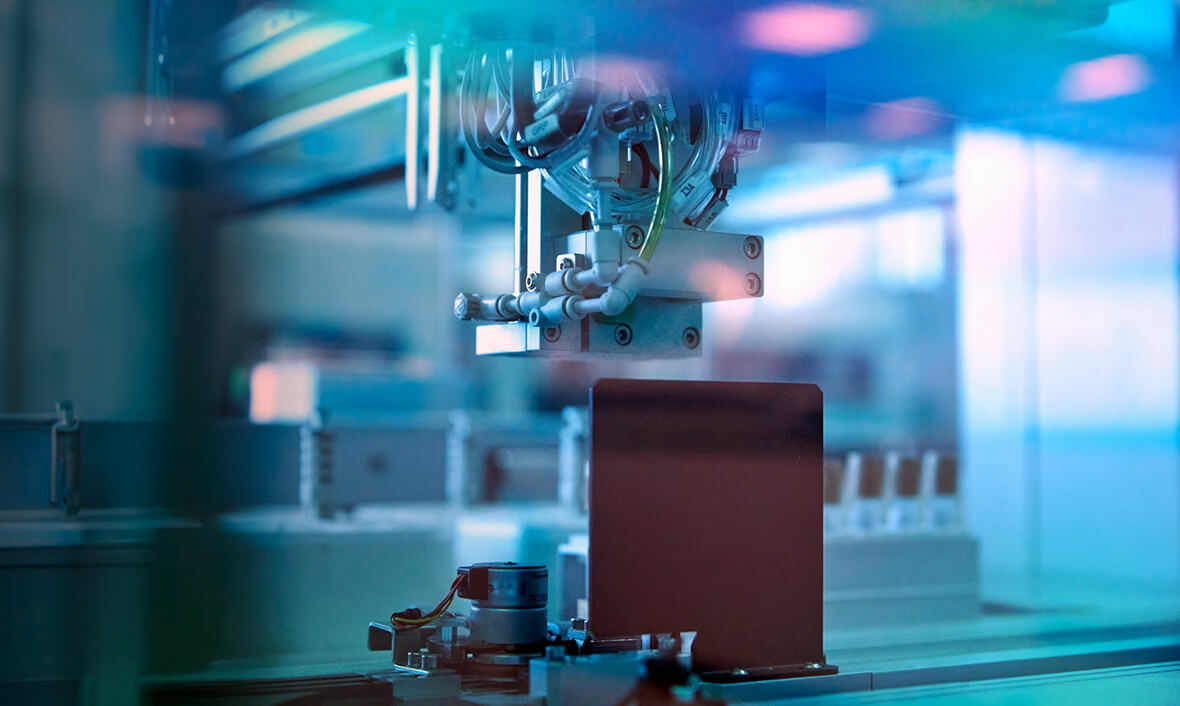

Alphial began as a so-called “buy-and-build” initiative, launched by Entangled Capital and Capital Dynamics in 2020 with the initial acquisition of SM Pack, a long-established company with plants in Parma and Bernareggio, Italy specialising in converting tubular glass into ampoules and vials for the pharmaceutical and cosmetics industries. In 2021, Crestani, founded in 1950 and specialising in the production of technologically advanced glass ampoules, joined the Alphial group. The buy-and-build initiative continued in 2024 with the acquisitions of Sicatef and Luxenia Umbro Tiberina, two companies with more than ninety years of experience. These two acquisitions enabled Alphial to consolidate its leadership position and become the largest European producer of glass ampoules and vials for pharmaceutical and cosmetic applications with a total annual production capacity of over 1 billion pieces and a European market share of around 30%.

Ethica Group, with its M&A Advisory team, advised Entangled Capital, a private equity firm focused on investing in Italian SMEs, and Capital Dynamics, an independent global asset manager specialized in private equity and renewable energy investments, on the sale of the pharmaceutical group Alphial to SGD Pharma, a leading French group in primary packaging for the pharmaceutical industry, already backed by the financial group PAI Partners.