Fausto Rinallo

Ethica Group

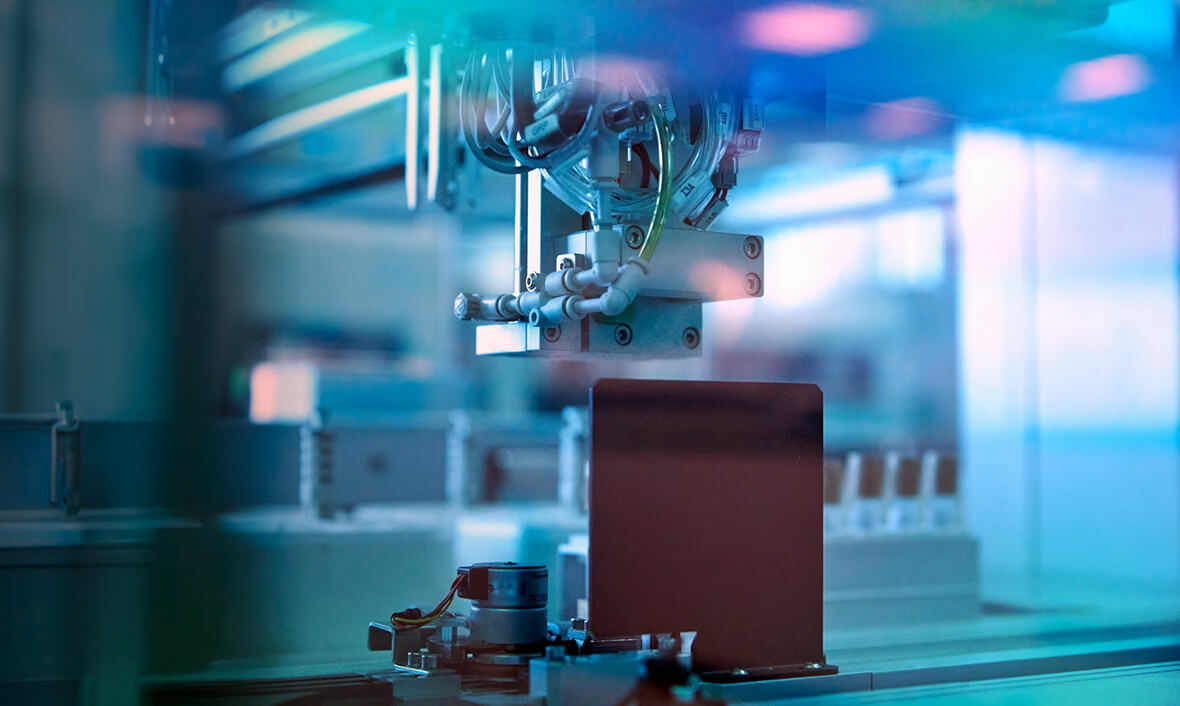

Doppel is a leading Italian operator in pharmaceutical research, development, formulation, manufacturing and packaging. The company operates exclusively on behalf of third parties as a Contract Development and Manufacturing Organization (CDMO).

Doppel, which was founded in 1994, has contracts with blue-chip Italian and international clients. It employs around 460 people and operates from two production plants in Northern Italy. The Company mainly manufactures and packs pharmaceutical products such as pills, pharmaceutical granules, creams, tablets, oral solutions, sprays and injection vials, produced under aseptic conditions or with terminal sterilisation. In 2009, the company launched a nutrition division, dedicated to the contract manufacturing and packaging of effervescent granules.

Ethica Corporate Finance advised the shareholders of Doppel in the sale of the 90% stake to Trilantic Capital Partners Europe, a private equity firm focused on mid-market transactions in Europe.

Trilantic’s acquisition of Doppel provided a full exit for the existing shareholders whilst the Doppel’s current Managing Director, Paolo Lanfranchi, will remain a shareholder with a 10% stake. On completion of the transaction, he will become Chairman of the Company.

The transaction process started with a strategic review leveraging on Ethica's knowledge of the Italian pharmaceutical market.

The process included pre-screening a short list of large multinational strategic acquirers and international private equity funds allowing us to identify the right candidate that matched the objectives of each different Doppel's shareholder (a number of Italian entrepreneurs).