Giorgio Carere

Ethica Group

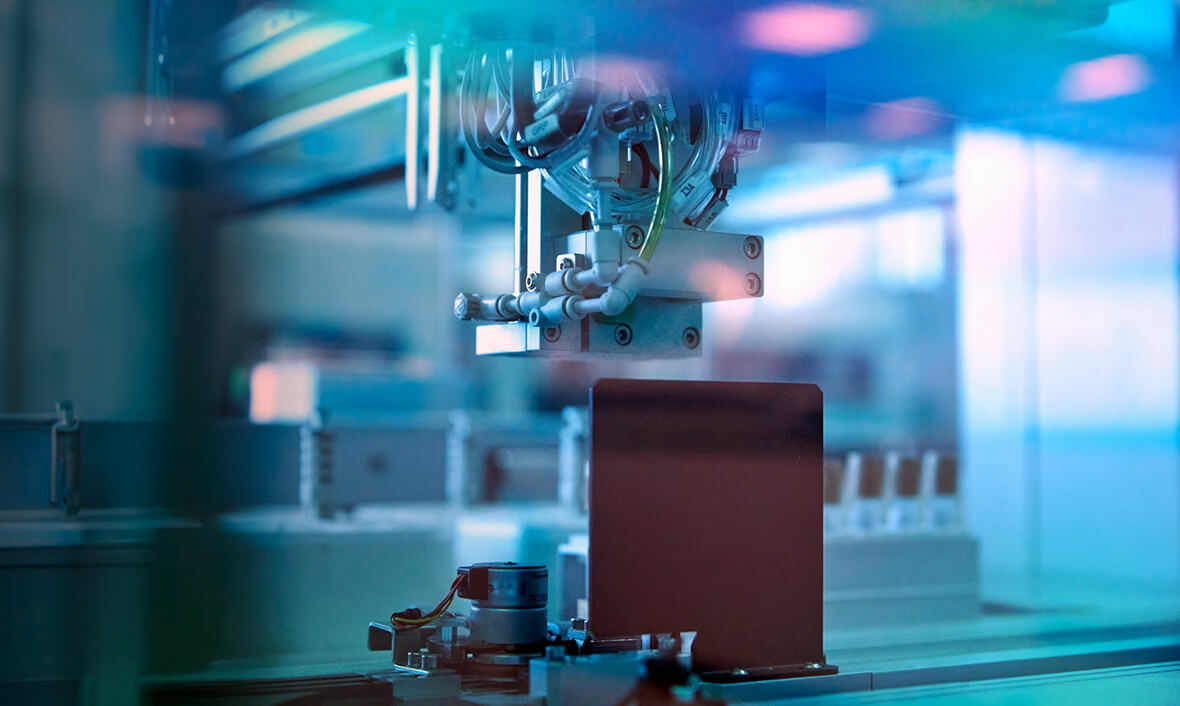

Founded in 2005 and headquartered in Arona, Italy, Apharm has over the years established itself as a leader in the market for food supplements and medical devices, relying on a solid IP of over ten patent families, especially in the areas of gastrointestinal and orthopaedic therapy, and approximately 40 globally registered trademarks. The Company generated more than €10 mln in revenues in 2018.

Ethica Corporate Finance advised the shareholders of Apharm, a leading player in the research and development of food supplements and medical devices, in the sale of a majority stake to Nutrilinea. Apharm founders, Angelo and Paolo Pizzoni will maintain a 30% stake in the company and will continue to operate with executive remit in the context of strategic development and product innovation and sales. This partnership will contribute to creating a leading European player in the production and development of nutraceutical products, strengthening R&D and concentrating on product innovation. This collaboration combines Nutrilinea’s high-quality manufacturing standards and operational flexibility with Apharm’s ability to develop new products.

Having acted as sell-side advisor in previous deals in the sector, Ethica has been able to leverage a solid knowledge of the reference market and players and managed a competitive sell-side process including both PE Funds and strategic buyers. Ethica supported Apharm founders by adding value both in terms of economics and in terms of finding the best strategic partnership.

We providing the platform for our group of talented and experiences partners to build personal and professional relationships.