Singhi Advisors served as the exclusive strategic and financial advisor to Gravita India Limited – an ~USD 1.3 billion market‑cap global recycling leader and one of the world’s largest players in lead recycling – on its acquisition of Rashtriya Metal Industries Limited (“RMIL”) for an enterprise value of ~USD 90 million.

Jaipur-based Gravita India Limited, is a leading global recycling company with 13 state-of-the-art manufacturing facilities worldwide, collectively capable of processing ~3,46,000 MTPA. With a presence in over 70 countries, the company operates across 5 business verticals.

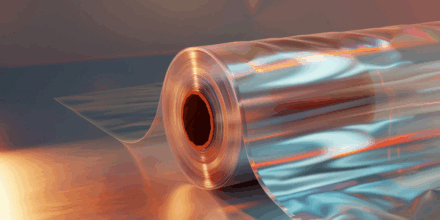

RMIL, valued at ~USD 132 million, is India’s oldest and among the most reputed manufacturers of copper and copper‑alloy products, including strips, coils and cups. Incorporated in 1946 and based in Mumbai, Rashtriya Metal Industries Limited, is a legacy manufacturer of copper and copper alloy products, including brass strips, nickel-based alloys, electroplated brass, case cups, serving electrical, automobile, lock and engineering applications. The company operates a manufacturing facility at Sarigam (near Vapi), Gujarat, with an installed capacity of ~24,000 MTPA and has consistently scaled its capabilities over seven decades. RMIL derives ~60% of revenues from domestic markets and ~40% from exports, with key geographies including the UAE, USA, Egypt and Saudi Arabia and is also supplying coin blanks to the Indian Government.

The acquisition enables Gravita to strategically diversify into copper and copper‑alloy products, expanding from copper scrap recycling to value‑added alloys. This complements its existing lead, plastic, rubber and aluminium businesses – enhancing integration, strengthening competitive positioning and improving margin quality. RMIL’s strong presence in electrical and automotive applications also provides Gravita access to a high entry‑barrier industry segment.

This transaction marks Singhi Advisors’ 11th deal in the Metals & Materials sector in recent years.